Efficient, safe and <span>independent</span> KYC data collection

Efficient, safe and independent KYC data collection

ONE data submission for all banking relationships

About the Platform

Platform Features

Direct Collaboration with Client via Chat

Avoid long and unnecessary email exchanges; chat functionality is available for quick resolution of all questions, including audit trail.

Aligned to FMSB industry standard

Driven by FMSB industry standards in the UK, plus the ability to build in-house questionnaires.

Automated Data Capture

Receive KYC data via a secure portal or automatically via an API. Direct feed from registry and OCR avoids dual-keying of information.

Clear User Access

ONE data submission for all banking relationships, status updates and regular reminders to keep data accurate.

Strict Data Privacy

Secure platform in line with data privacy rules and requirements, owned and administered privately and independently.

Secured Document Exchange

Eliminate all email exchanges. Documents and communications in only one place, secured by platform unique features.

Know more

Who We Are

We’re a company aiming to improve KYC industry

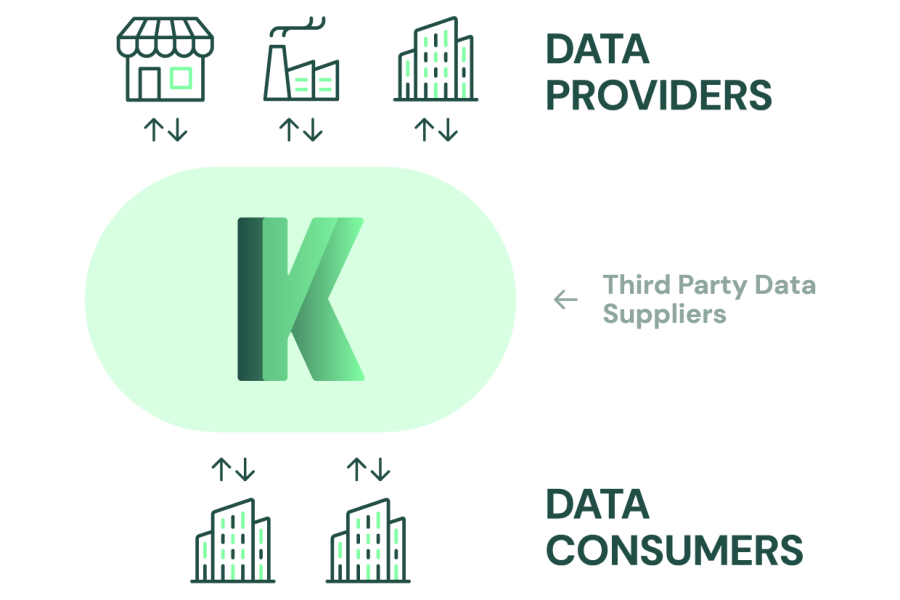

We are aiming to improve the KYC processes by facilitating banks, asset managers and corporates to seamlessly share information and documents on a secure platform throught the client lifecycle from on-boarding through recertification to off-boarding.

- Improve quality and availability of KYC data

- Promote a safe, and operationally efficient, financial system

- 100% client focus

Know more about us

News & Events